Key Points:

- The Bank of Japan’s interest rate increase caused a significant rise in the yen, disrupting carry trades and resulting in losses for investors.

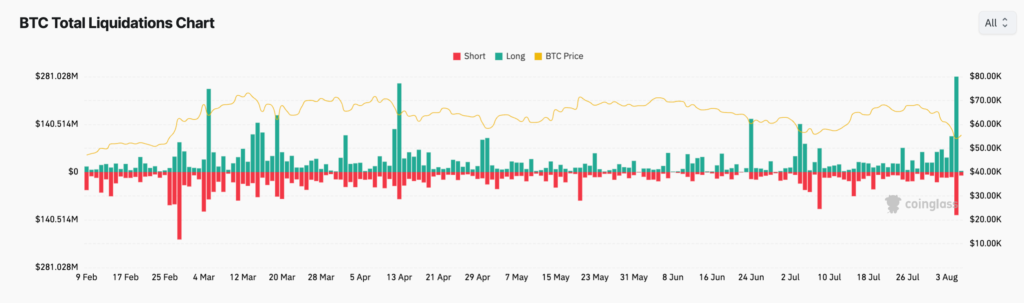

- More than $1 billion worth of leveraged cryptocurrency positions were liquidated in a single day, worsening Bitcoin’s drop.

- Bitcoin’s recent price movement resembles the market crash of March 2020 during the Covid-19 pandemic, prompting some traders to expect a similar recovery.

In August, Bitcoin (BTC) is experiencing a severe decline. As of August 6, the leading cryptocurrency had dropped by 14.50% for the month. At its lowest point, it had plummeted approximately 23.25%, hitting a six-month low of around $49,580.

Reasons Behind Bitcoin’s Significant Price Drop

The Bitcoin selloff in August has been intensified by several bearish factors emerging simultaneously.

On July 31, 2024, the Bank of Japan increased its interest rates from 0% to 0.25%, leading to a rapid appreciation of the yen. This unexpected move caught many investors by surprise, as the yen had been a popular choice for carry trades due to its previously low rates. Investors who had borrowed yen to invest in higher-yield assets, including Bitcoin, faced significant losses and had to liquidate their positions.

The rate hike and the yen’s appreciation also sparked a broader market sell-off. The Nikkei 400 index experienced its steepest two-day decline since 1987, and global markets followed with notable drops. This overall market instability added further selling pressure on Bitcoin.

The rapid price drop triggered a wave of liquidations in leveraged trading positions, compounding the decline. Over $1 billion in leveraged positions were liquidated within 24 hours, marking the worst liquidation event since March 2024.

Additionally, disappointing economic data from the US, such as a weak jobs report, heightened recession fears, further dampening the demand for riskier assets.

Intriguing Observation: Bitcoin’s Price Pattern Resembles the Covid-19 Market Crash

As of August 6, Bitcoin had surged to $56,275, a 13.51% increase within 24 hours after hitting a six-month low below $50,000. This rebound is occurring against a backdrop of growing recession concerns, leading investors to anticipate that the Federal Reserve may intervene.

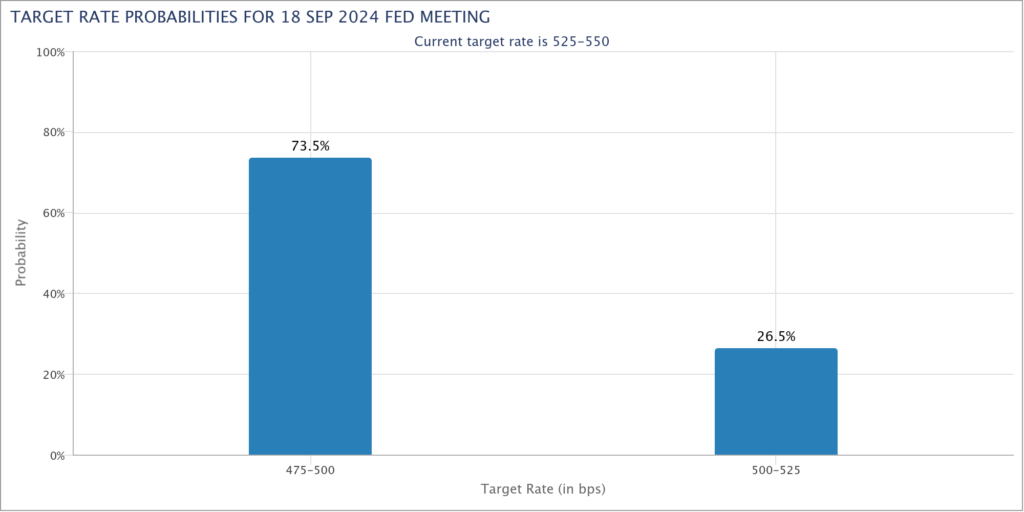

Currently, futures markets are predicting a more than 50 basis point (bps) rate cut by September and 125 bps by December, up from the previously expected 25 bps cut in September.

This situation bears a striking resemblance to the Federal Reserve’s actions during the March 2020 market turmoil caused by Covid-19 lockdowns. Back then, the Fed slashed interest rates to near zero and increased market liquidity by purchasing US Treasury bonds. This intervention led to a significant Bitcoin rebound and one of its most notable bull runs.

The parallels between March 2020 and August 2024 are leading some traders to expect a similar rebound in Bitcoin’s price. For example, a crypto influencer known as “Captain Faibik” has shared a chart suggesting that Bitcoin might follow a similar recovery pattern and could potentially reach $156,000 in a best-case scenario.

Leave a Reply