What are the most effective ways to use TA data for cryptocurrency trading?

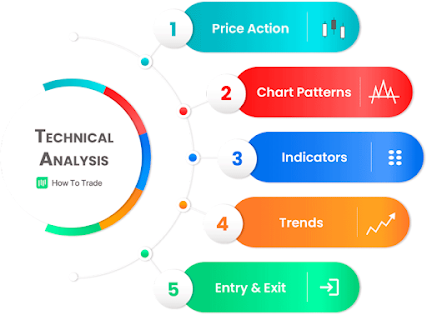

Technical analysis (TA) is a method of analyzing price movements and trends in financial markets, such as cryptocurrencies, using historical data and patterns. TA can help traders identify potential entry and exit points, as well as assess the strength and direction of the market. However, TA is not a magic bullet that guarantees success. It requires skill, practice, and discipline to use TA data effectively for cryptocurrency trading. In this article, we will discuss some of the most effective ways to use TA data for cryptocurrency trading, such as:

1. Choosing reliable data sources

One of the first steps to use TA data for cryptocurrency trading is to choose reliable and accurate data sources. Since cryptocurrencies are decentralized and traded on various platforms, there may be discrepancies and inconsistencies in the data available. Therefore, it is important to select data sources that have high liquidity, volume, and reputation, as well as low fees and latency. Some examples of reliable data sources are CoinMarketCap, TradingView, CryptoCompare, and Binance.

2. Applying the right tools and indicators

Another way to use TA data for cryptocurrency trading is to apply the right tools and indicators that suit your trading style, strategy, and objectives. There are many types of tools and indicators that can help you analyze the data, such as trend lines, support and resistance levels, moving averages, Fibonacci retracements, RSI, MACD, Bollinger Bands, and more. However, not all tools and indicators are equally useful or relevant for every situation. Therefore, it is important to understand the purpose, logic, and limitations of each tool and indicator, and use them in combination and moderation.

3. Developing a trading plan and system

A third way to use TA data for cryptocurrency trading is to develop a trading plan and system that guides your decisions and actions. A trading plan and system is a set of rules and criteria that define your entry and exit points, risk and reward ratios, position sizes, stop losses, and take profits. A trading plan and system can help you avoid emotional and impulsive trading, as well as improve your consistency and discipline. A trading plan and system should be based on your TA data analysis, as well as your personal goals, risk tolerance, and market conditions.

4. Backtesting and reviewing your results

A fourth way to use TA data for cryptocurrency trading is to backtest and review your results regularly. Backtesting is the process of testing your trading plan and system on historical data to evaluate its performance and profitability. Backtesting can help you identify the strengths and weaknesses of your trading plan and system, as well as optimize and refine it. Reviewing your results is the process of analyzing your actual trades and outcomes to learn from your mistakes and successes. Reviewing your results can help you improve your skills, knowledge, and confidence as a trader.

5. Keeping up with the market news and sentiment

A fifth way to use TA data for cryptocurrency trading is to keep up with the market news and sentiment. While TA focuses on the price action and patterns, it does not account for the external factors and events that can influence the market behavior and psychology. Therefore, it is important to complement your TA data analysis with the market news and sentiment, such as regulatory developments, industry trends, social media buzz, and public opinion. Keeping up with the market news and sentiment can help you anticipate and adapt to the market changes and opportunities.

6. Continuing your education and learning

A sixth and final way to use TA data for cryptocurrency trading is to continue your education and learning. TA is a dynamic and evolving field that requires constant updating and improvement. Therefore, it is important to stay curious and open-minded, and seek new sources of information and inspiration. You can continue your education and learning by reading books, articles, blogs, podcasts, and videos on TA, as well as following and interacting with other traders and experts. Continuing your education and learning can help you expand your horizons and perspectives, as well as enhance your creativity and innovation.

7. Here’s what else to consider

This is a space to share examples, stories, or insights that don’t fit into any of the previous sections. What else would you like to add?

Leave a Reply