Bitcoin is thriving due to economic imbalances, institutional distrust, fiscal recklessness, and rising debt, says VanEck’s Matthew Sigel.

-

By 2050, Bitcoin might facilitate 10% of international trade and 5% of local trade, with central banks holding it as a reserve asset, according to a report by asset manager VanEck.

-

The report also noted that Bitcoin layer-2 networks would be crucial in addressing scaling issues, enabling BTC to function as a medium of exchange.

-

However, Bitcoin’s growth faces several risks, including increasing power demand, potential coordinated government crackdowns, and competition from other digital assets, as highlighted in the report.

Asset manager VanEck, known for issuing spot Bitcoin (BTC) and Ether (ETH) ETFs, suggests that BTC’s price could reach $2.9 million by 2050, provided significant challenges are overcome. In a report released on Wednesday, VanEck anticipates Bitcoin becoming integral to the international monetary system as geopolitical tensions rise and debt servicing costs balloon, undermining the current system.

Matthew Sigel, VanEck’s head of digital asset research and co-author of the report, stated in a CNBC interview, “As we look at the world right now, we see enormous economic imbalances, rising distrust in existing institutions, and continued deglobalization.” Sigel attributed many of these issues to a massive misallocation of capital since the global financial crisis, with G7 governments excessively printing money and borrowing for unattainable goals. He emphasized, “Bitcoin is the ultimate hedge against this rising fiscal recklessness.”

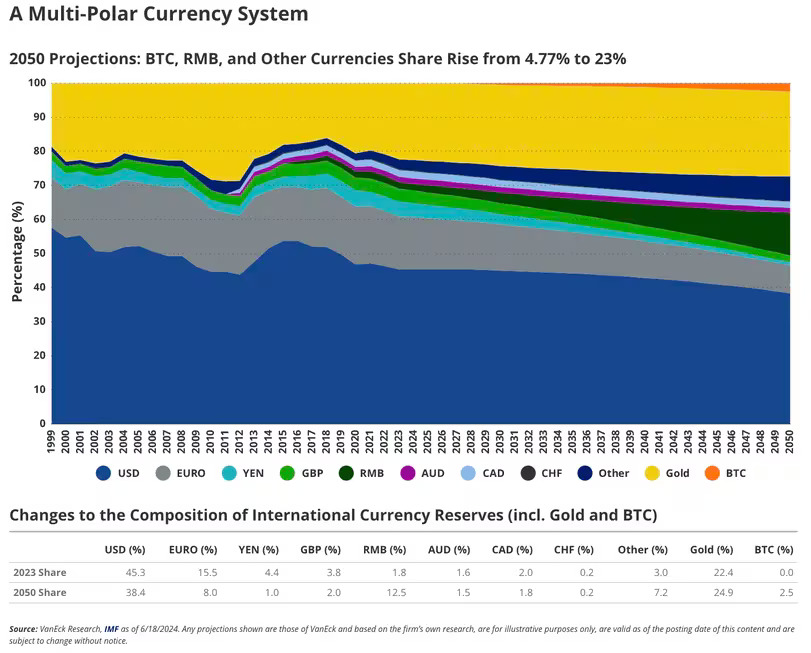

The report’s base case scenario envisions BTC becoming a key medium of exchange in local and global trade, accounting for 10% of international trade settlement and 5% of GDP. Additionally, Bitcoin could become a global reserve asset, rivaling the U.S. dollar, euro, British pound, and Japanese yen, and achieving a 2.5% weight in international currency reserves.

Should VanEck’s projections materialize, Bitcoin’s price would increase 44-fold, growing 16% annually from its current price of just below $65,000, and its market capitalization would soar to $61 trillion. The report highlights the importance of layer-2 networks in addressing Bitcoin blockchain’s bottlenecks and scaling issues, enabling BTC to serve as a useful medium of exchange. These layer-2 networks could collectively be worth $7.6 trillion by 2050, using a similar valuation framework as Ethereum layer 2s.

However, VanEck also cautioned about potential risks that could hinder Bitcoin’s growth. These include the increasing energy demands of miners, which will require innovation, and the need for substantial growth in transaction processing revenue to compensate for diminishing mining rewards, which are halved every four years. Additionally, coordinated efforts by governments to restrict or outlaw Bitcoin, competition from other cryptocurrencies, and the risk of large financial institutions exerting excessive control over the market pose significant threats to Bitcoin’s future.

Leave a Reply